What does the Fed’s September meeting & the rate shift mean for you? (3 min read)

If you are A) an active investor in real estate B) hold a mortgage of any property or C) looking to buy your first property, this post is for you.

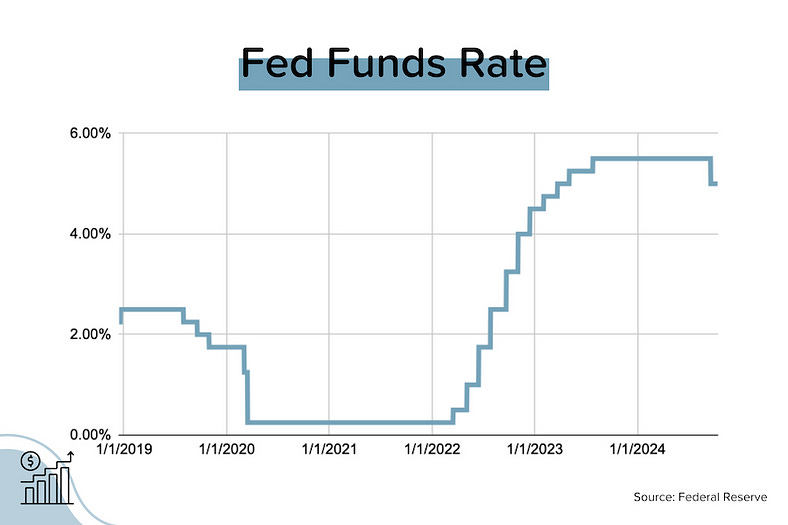

To make a very long story short, the Federal Reserve lowered the Federal Funds Rate 50 basis points this past week. The first time the actual Fed rate has shifted in 2 years. It is a relatively big deal in the real estate world. One thing to point out — the mortgage rates had already baked in this Fed shift, a full month ago. Mortgage rates started dropping mid-August. In fact, last week mortgage rates actually went up, due to bond yield activity. All that to say, it is incredibly likely we see the Fed rate continue downward in conjunction with mortgage rates continuing to creep downward. For reference, the average on a 30-year mortgage today is 5.89% according to NerdWallet.

What does the shift mean for you, though? I’m going to break down what is happening and what to expect in Indianapolis real estate —

Since rates nearly doubled since early 2022 we have seen some major changes:

- The commercial real estate world nearly grounded to a halt. Many operators faced a bleak bottom line with higher debt payments, as the commercial world operates on variable rate debt. Sellers wanted COVID-era values, while new buyers wanted values that can actually cash flow.

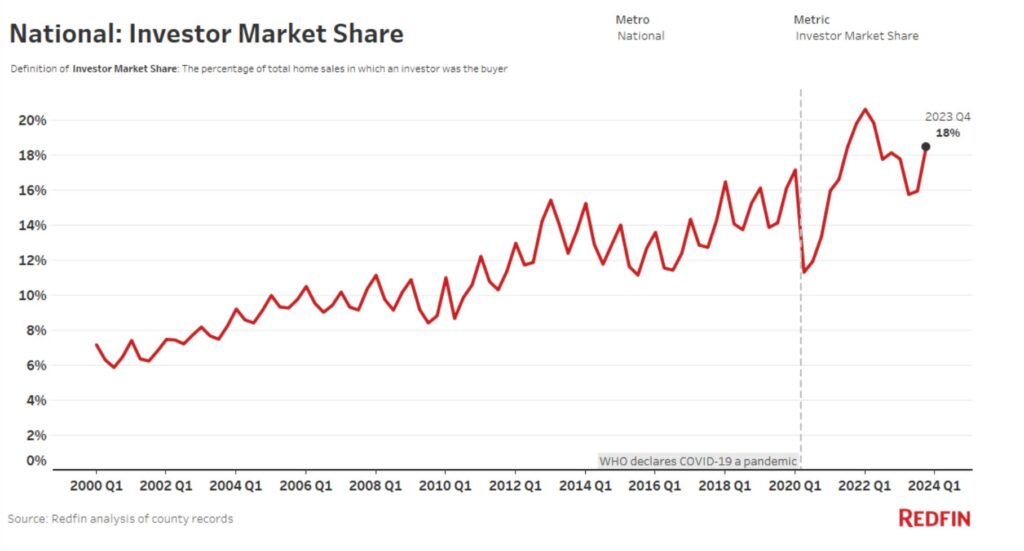

- The share of investors in the real estate market plummeted. In 2022, the fear was that every property would end up in the hands of a landlord. We did see investors pause on the buying spree, taking time to re-assess.

- Prices did stabilized, not “corrected”. Despite some markets like Austin & So Florida having pretty severe corrections, nationally prices have risen consistently YoY since COVID.

- In Indianapolis we have seen this trend: the “hot” markets such as Carmel, Zionsville, Fishers, Avon, Broad Ripple, Nora have remained Seller-friendly with continued appreciation. The “investor-focused” markets such as Near Westside, Near Eastside, Martindale-Brightwood have had a much softer market with less buy-side activity. In effect, you could get a property for nearly the same prices as amidst COVID in one of these areas for the past few years.

As rates went up, the share of investors in the market did go down, however it has been rebounding. A “pause” effect.

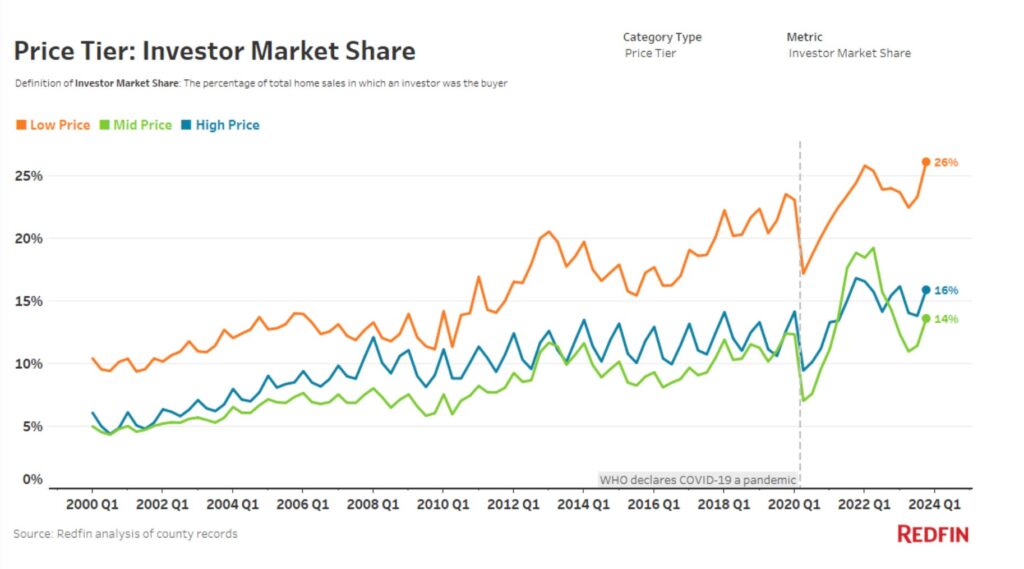

Investors tend to be more active in the “low price” category… Big surprise…

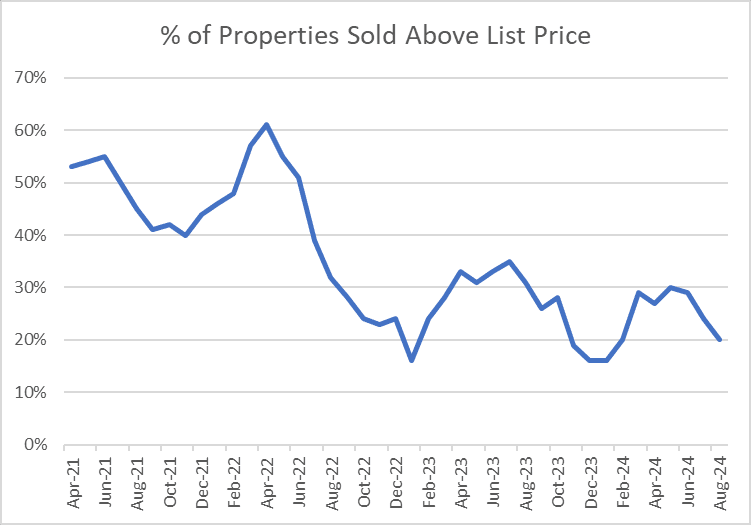

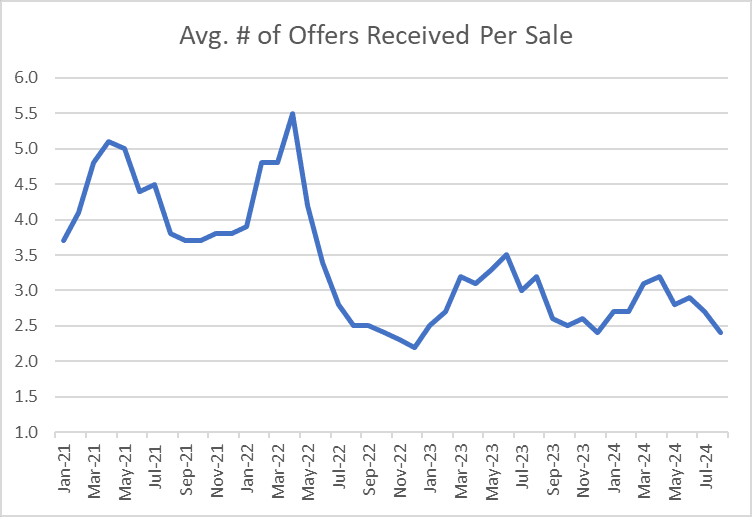

Peak era of properties sold above list price – 2020-2022

Peak era of # offers received per said 2020-2022

So, yeah: Rates shifted, now what?

I don’t want to overemphasize a 50 bp rate shift… There will be MANY more rate cuts in coming months, with the next meeting being in December. However, it certainly deserves some reflection on how to proceed as an investor-minded individual in the market:

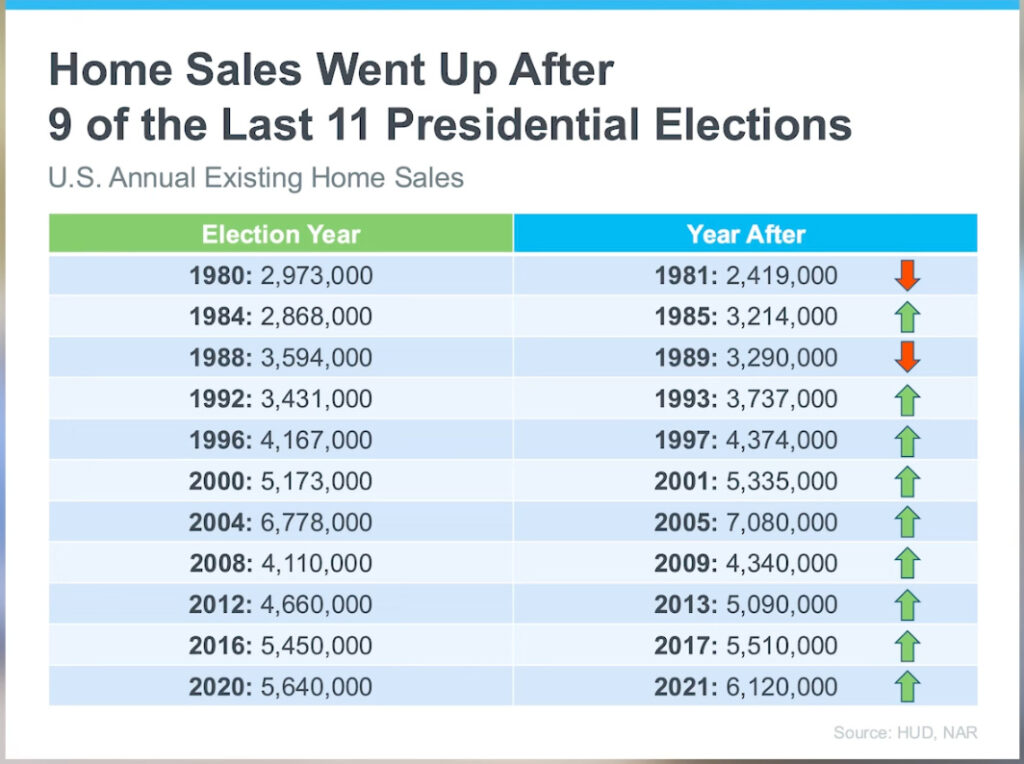

- The “heat up” is going to happen in early 2025. We are going to see a lot of buyers ready to take action in the new year. New year, new president, new Fed policy… I expect a strong year of appreciation in the 5-10% tier in 2025 for Indianapolis. In 9 of the last 11 elections, prices went up in a post-Election year.

2. High refinance activity in early 2025. Mortgage lenders will have their hands full early next year as well as folks try to time the drop and refinance their 6%+ rates. This will open up more disposable cash to re-invest, further increasing overall appreciation.

3. The news for Cash flow investors: If you bought a steal of a deal in 2023-2024, refinancing will help your cash flow considerably. I’ll be refinancing a mortgage I have from $2300 / mo to likely $19000 / mo if rates hit my desired mid-5’s on an investment property (we will see…). HOWEVER, those on the sidelines waiting for better rates for better cash flow won’t see it, in my opinion. On new purchases, cash flow gains will likely be eaten up by rising property values. Thus, the age old on saying, “The best time to buy real estate was yesterday,” remains true.

4. Kelly School of Business predicted Indiana’s population to grow by 383,000 from 2020 to 2060. This is actually a modest gain of 5.6%. However, it predicted that much of that growth would be from 2024-2030, with an expectation of 230,000 additional residents by 2030. Much of this growth concentrated in the Indy Metro. What do you think will happen when an already direly low housing supply will be inundated with 200,000+ residents in the next few years?

5. What next? Cash flow is going to be harder and harder to find, especially in the Class B and above neighborhoods. Values and population are simply rising too quickly. What hasn’t been mentioned enough is the increase in property taxes & homeowner’s insurance, as well. In fact, the best way to find cash flow will be to have bought the property in past years, and refinance when rates lower. Buying a property in an “in demand” area now that will benefit from the population influxes expected by 2030 is smart. Buy it in the black, make sure it doesn’t lose money every month, and hang on! The best is yet to come, but don’t expect acquisition to be easier in 2025!