5 Bold Predictions for 2025 in Spheres of Interest Rates, Housing Economy, and more…

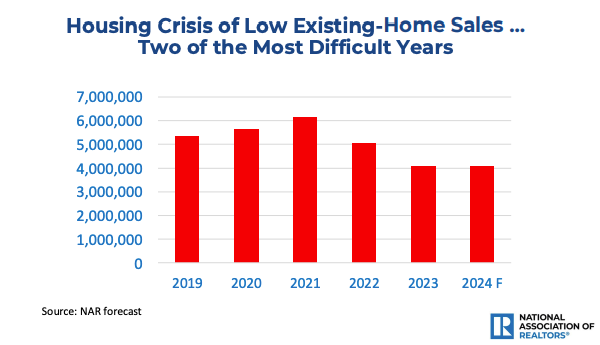

I’ll be honest, the last 2 years in real estate have sucked. I’ve felt it. It feels like things were unnaturally slow & difficult.

We have not seen this low of transaction count until you go back to 1995 or 2009. Those were horrible markets. Prices were falling during those times. Prices did not fall in 2024, however, closed sales were meager at best.

Many realtors, lenders, investors, homeowners are wondering when we will get back to a “normal” market cycle. Normal would be defined as at least 5M home sales nationally. In 2024, we barely scratched over 4M in 23-24. This may not sound like much of a difference, but that’s actually entire careers washed out for some folks…

It was difficult. But are things going to change?

Two of the most difficult years

Five Predictions for 2025 in Real Estate:

#1. The “Lock-in” effect will erode.

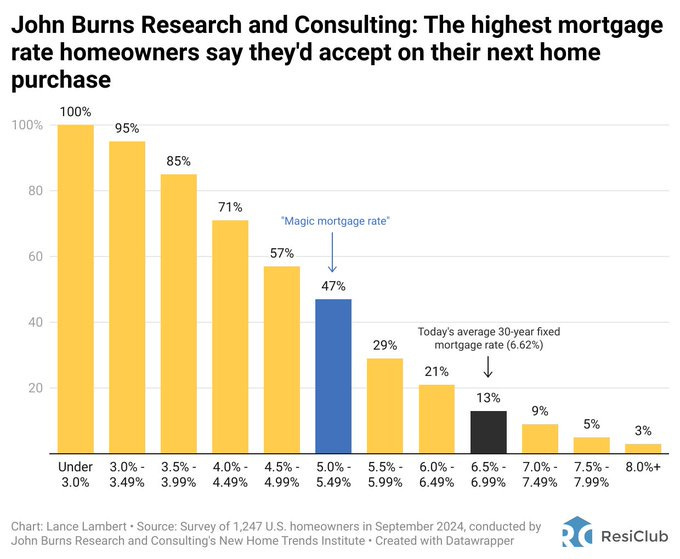

The “lock-in” effect is the tendency for those with mortgages from 2020-2022 at around 3-4% to remain “locked-in” and avoid making moves to lose their ultra low rate. It makes sense.

However, does it make sense for a family of 5 to be cooped up in a tiny Broad Ripple bungalow for forever? No.

People move in real estate not based on the math, but primarily based on their life situation: marriage, having kids, divorce, death, new jobs, etc.

According to the graph above, nearly 50% of folks would make a move when rates hit around 5.5% — this is what many economists see as the “magic rate”. Will we see that rate in 2025? I don’t think anyone knows for sure, but I honestly don’t see it.

With that being said, a LARGE component of the population will say “Enough” and decide to make their necessary moves in 2025-2026.

Prediction: Closed transactions will go up. We will once again see 5M+ home sales in the US.

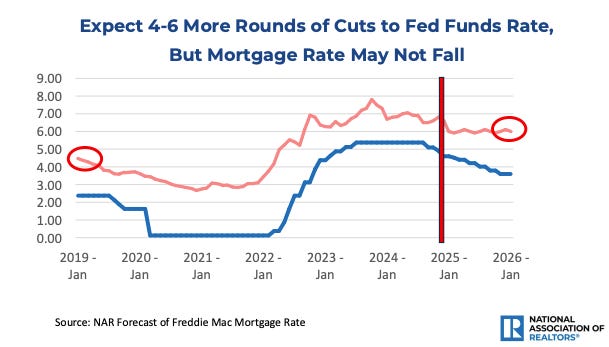

#2. Rates will remain in the 6’s throughout 2025.

The Fed is indeed expected to continue to cut the Federal Funds Rate.

However, that will not have much effect on mortgage rates. How could this be the case??

That is because the mortgage rate is correlated with the 10-year treasury bond yield. Bonds have been declining in value. Why? Investors in the capital markets are seeing a robust economy and ever present inflation. Inflation High = Low Bond Prices = Higher Mortgage Rates.

Indeed, we need a losing economy for rates to have a meaningful reduction in mortgage rates. Catch-22 much?

The reality is 6% is the new norm. And folks are indeed getting over it and moving on. Historically this is actually lower than the 30 year average (which is around 7.7%).

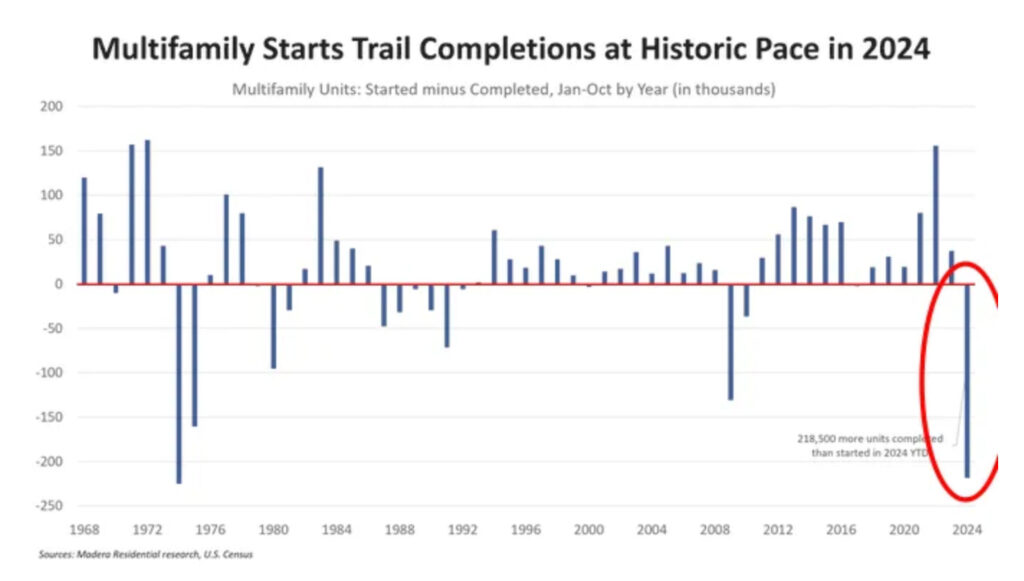

#3. The rate-hit in the past 3 years will have an outsized effect on new housing starts nationally (It already has).

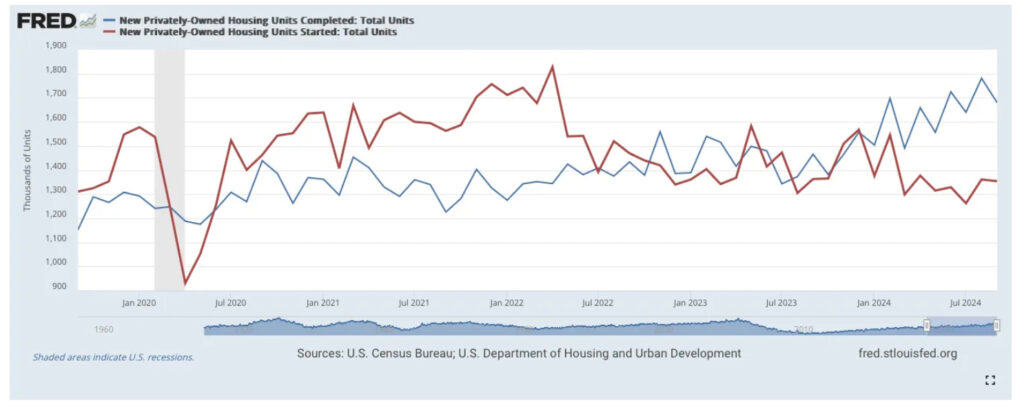

Red line is housing starts, Blue line is completions. Starts = Going Down.

The build starts of new housing has slowed considerably in 2024.

According to one of my favorite real estate writers, Andreas Muller: “This separation between starts and completions is obvious in hindsight. Two+ years of higher costs, as well as regulation complexity, are disincentives to building. The relatively healthy number of housing completions today was the result of 0% ZERP interest rates in 2020-21.” He continues, “We are not starting enough new housing projects (no not those kinds of projects) to maintain the housing stock we have, undersupplied as it may be, let alone grow supply.”

Translation: In many markets in the US, builders just have low to no incentives to keep up the building. The reason we got into the inventory crunch in the first place was due to a slow down in building after the 2008 sub-prime mortgage bubble. Another slow down like this will have supply-side detrimental market effects.

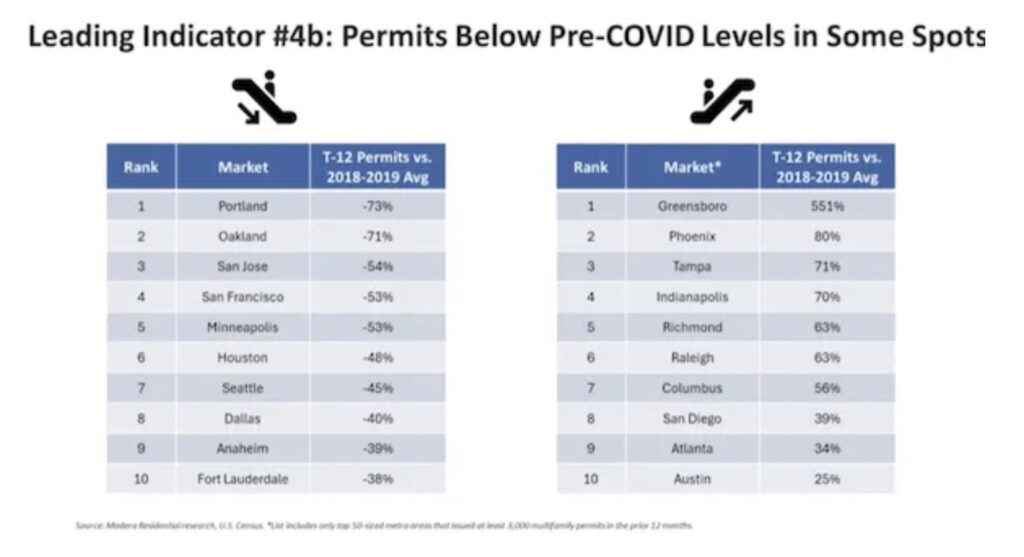

Not all markets are reacting the same, though. Indianapolis traditionally has much less red tape, regulation, and consistent population / economic growth. That is proving to be a huge boon for housing starts here locally. While many cities are deathly below pre-COVID levels of housing starts (especially in California), other cities are crushing it with starts. Indianapolis is ranked #4 as compared to pre-COVID building permits

Not all cities have been affected by interest rates, regulation, and the overall past 3 years the same: Indianapolis is cranking out new housing starts showing robust signs of a healthy market.

#4. 2025 will be one of the biggest years for first time homebuyers.

First time homebuyers have mostly been left out of the party the last 4 years. Prices & rates have gone up, and they have nothing to show for it.

I have no fancy graphs to show for this one, only on the ground anecdotal experience. In my realty practice with Roots Realty Co., we service homeowners, investors, and first-time homebuyers. First time homebuyers are the #1 group piping up and making moves in the marketplace right now. For good reason!

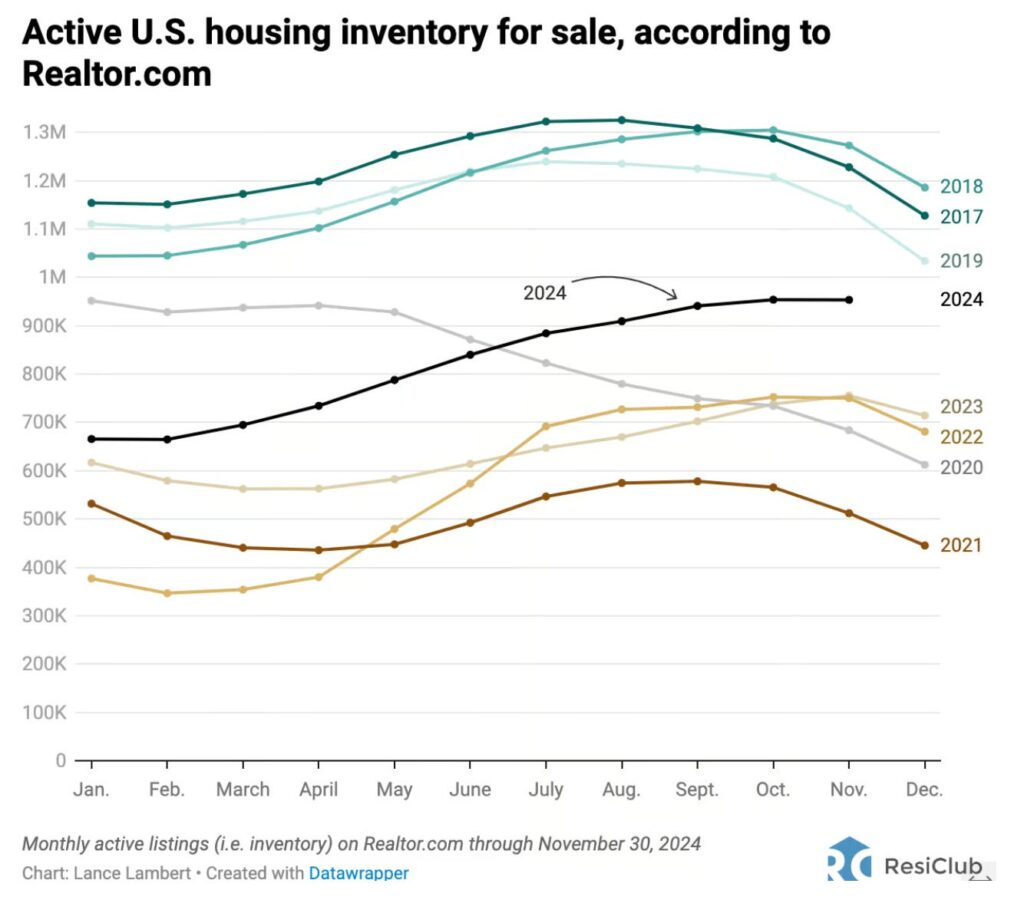

The Opening: There’s an opening in the market happening. We have had the most Price Changes from sellers in 3+ years in Indianapolis, indicating the market has subtly shifted in favor of buyers. There’s been a stagnation in the fierce competition as inventory has rebounded. More inventory = Less competition = Better environment especially for first time homebuyers.

The back half of 2024 saw Housing Inventory climbing, a great thing for first time buyers!

All that to say, Millennial first time homebuyers, do have the income to be able to afford a first home — the median income is around $71,000 (Source: US Census Bureau). With an FHA Loan, on a $300K purchase, they only need around $20K to get into a great home (at least in Indy). These folks have mostly been waiting it out, for the right time to strike, whilst renting (and seeing those rents go up!).

In 2025 and 2026, the waiting game will mostly come to an end. First time homebuyers are going to strike, and be one of the dominant groups present in the marketplace. This is especially true in an affordable market like Indianapolis, less so on the East or West Coast where things are much more out of reach for a first-time buyer income.

#5. A “good year” for most all markets.

The Election and the DOGE committee has so far been a boon for the markets. Will President Donald Trump ruin the economy in tariff-infused trade wars? I tend to believe that tough-tariff-talk is merely a negotiation tool that will have a very negligible effect on the actual economy.

What if Inflation does fall to the Fed’s target of below 2.5% in 2025?

What if AI does lead to huge growth gains for the largest tech companies in the United States?

What if companies can save millions of dollars from AI and Virtual Assistant / Off-shore employees versus traditional higher-paid US employees?

We could indeed be on the precipice of a huge growth cycle in the United States economy. Things seem to be lining up…

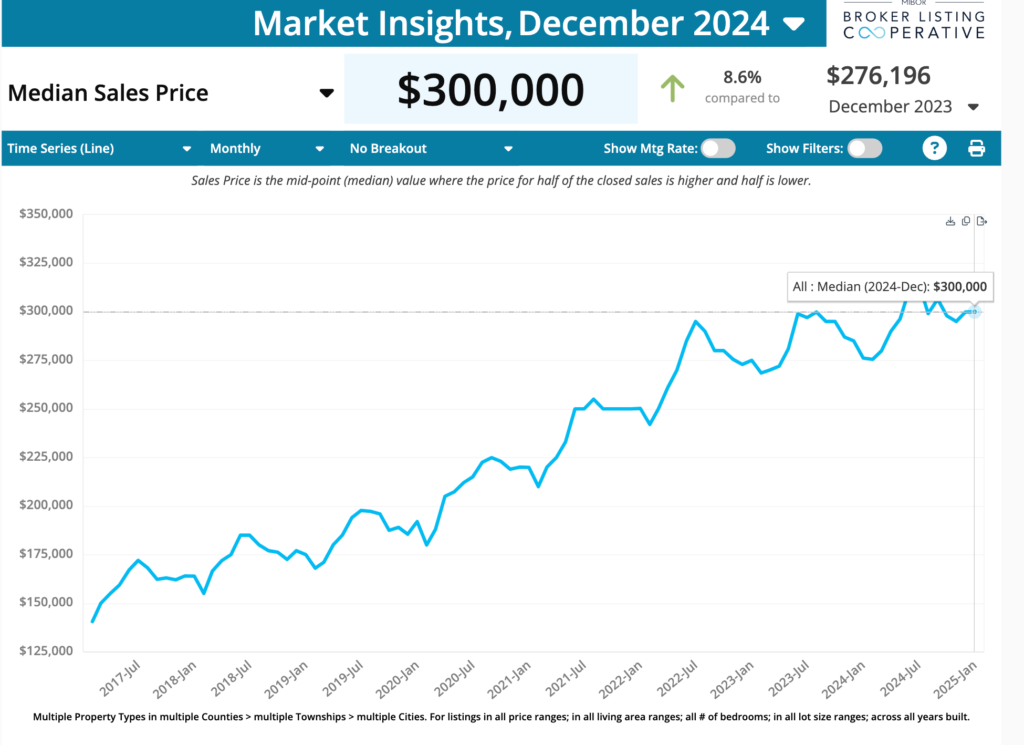

It’s seeming quite likely that we see a healthy stock market (6-10% growth) and robust real estate market in 2025-2026. In Indianapolis, as Nationally, home values hit their record median-price this past year. That’s in a sub-par housing economy with relatively high rates(!)

What could be possible when rates do indeed hit the mid-5’s by 2026?

(I just hope the housing starts nationally go up, because at this trend we are heading towards another 2019-2020-like marketplace.)

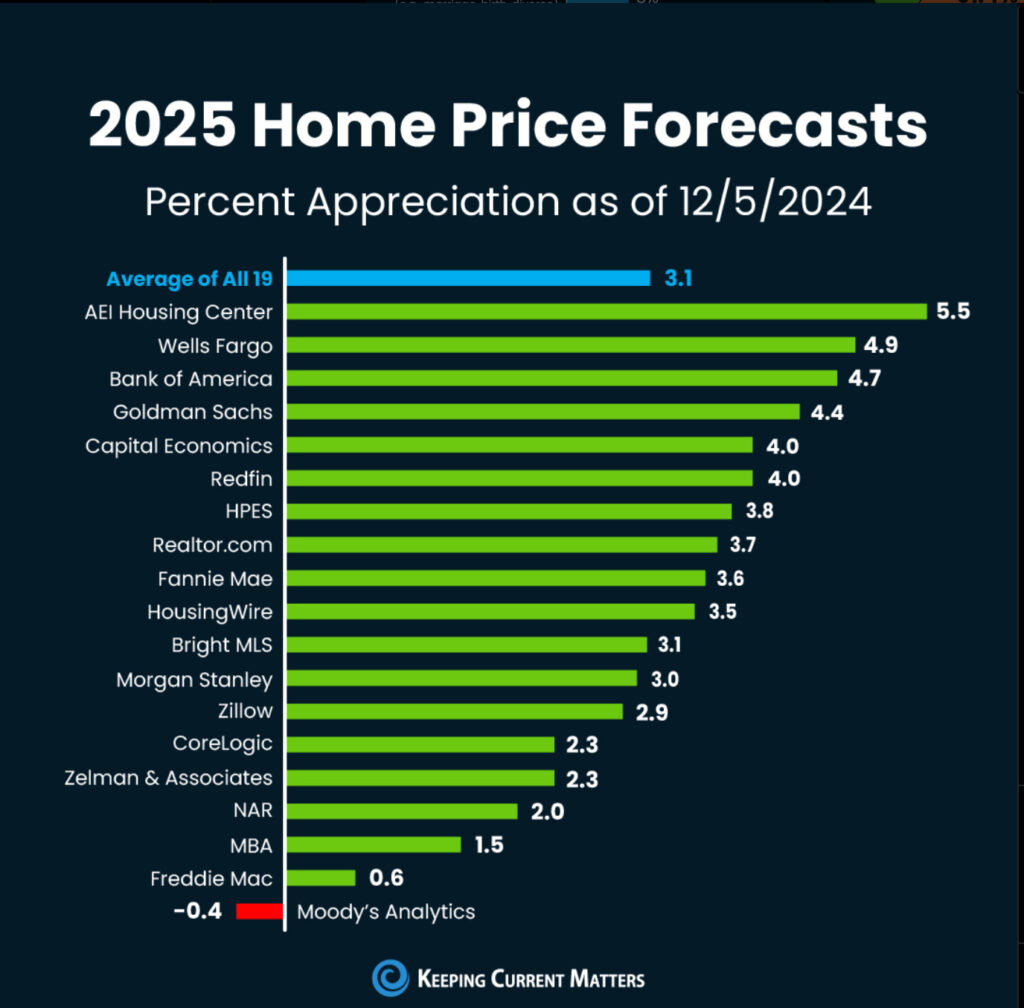

Prediction: Next year I am predicting 4% home appreciation in Indianapolis, which incidentally, is the same as Redfin’s national home appreciation forecast.

Average home price appreciation forecast – 3.1% Nationally

In June 2024, Indianapolis hit a Median Price record of $315,000. Indianapolis has traditionally been a good proxy for the national marketplace.

On the whole —

2025 will be a great year for real estate. Will rates go down into the 5’s? Who knows, but it’s looking like No at this rate. We will likely have ~4% home price appreciation. First time buyers will finally get in the game. Investors will have a decent year with excellent equity-gain, cash flows will still struggle amidst higher costs of doing business (taxes, insurance, cost of contractors). The whole pie will grow, and those who are in the game will receive their share of benefits.

Need a consultant to talk through, or an investment-minded agent? Schedule a chat.

Just want to learn more, download my One pager with resources on Indianapolis & all things real estate.

Cheers,

Tyler