Welcome to the PLANT ROOTS Market Update! Your October insights into the Indy market.

The Facts:

As a data-driven individual, this month’s market update has me genuinely excited. For the first time in a while, I get to share some charts that have finally become relevant enough to discuss. We’ve been navigating a market of suppressed demand, driven by high interest rates, where even minor fluctuations have kept everyone on edge. Over the past two years, the outlook has been pretty bleak.

While market research is great for understanding the past, it doesn’t necessarily dictate the future. The media, market experts, and just about everyone else love to treat data like a crystal ball, predicting what’s to come. And while I’m all for learning from history to shape our strategies, we have to remember that the future isn’t set in stone. All signs point to 2025 being a dynamic and active market in Indianapolis, and that’s exactly what the data suggests.

But let’s not get ahead of ourselves! It’s still very much 2024, despite all the hype about what’s next. The real question is—what’s happening in the market right now?

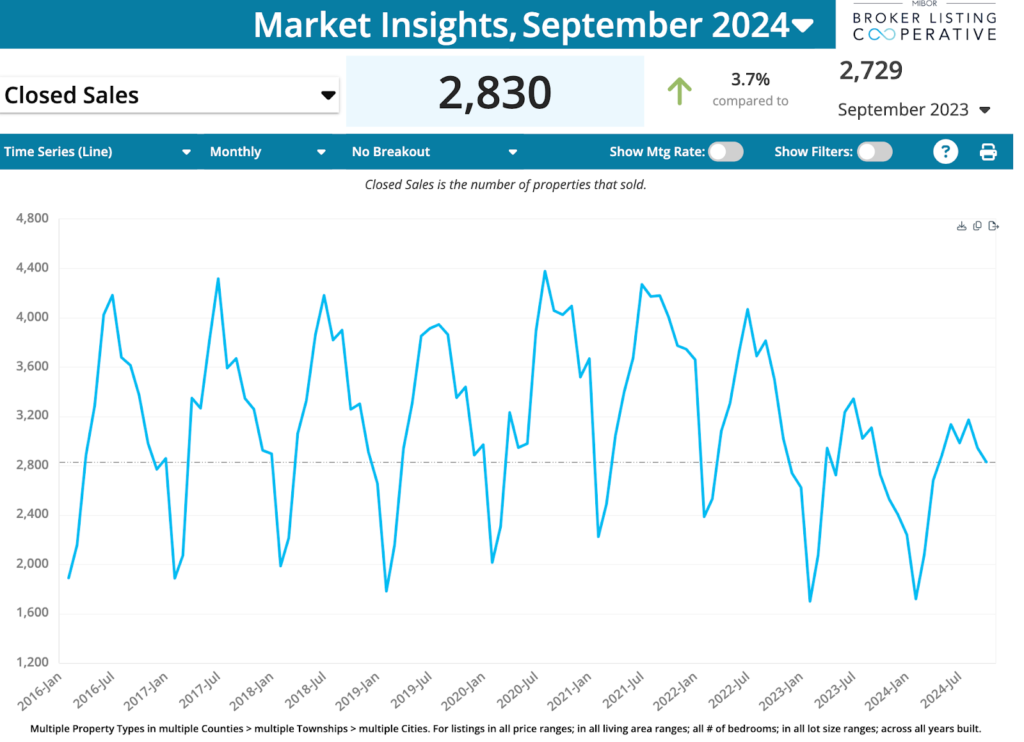

Closed Sales: Jan ’16 – Sept ’24:

What stands out here?

One clear trend is how consistently the market dips at the same time every year—spring is busy, fall cools off, and winter slows down before picking up again. But what really jumps out is just how low sales have been in 2023 and 2024. Even during peak months, these years barely reached the levels of the slowest months from 2016 to 2021.

On a positive note, September 2024 showed a 3.7% increase in closed sales compared to the same time last year. While we’re still not seeing the highs of previous years, this slight uptick could be a sign that the market is starting to stabilize as we move toward a potentially more active 2025.

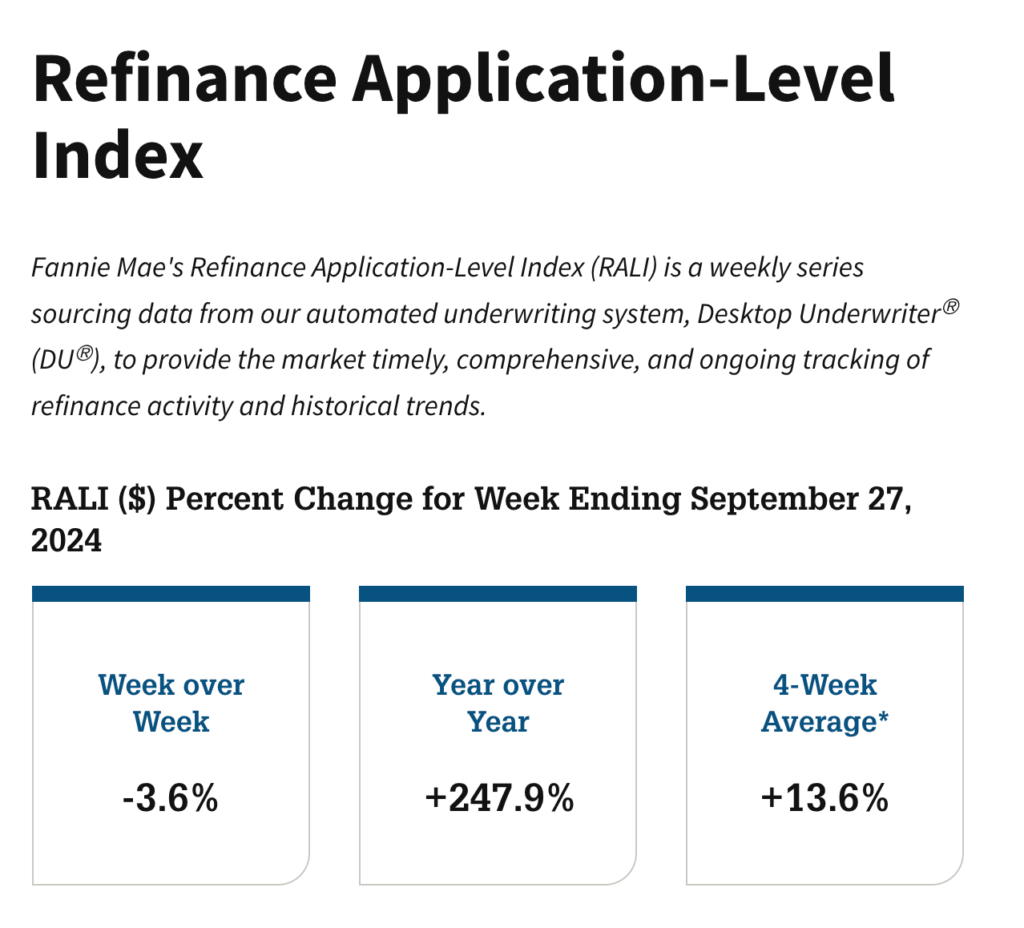

Refinance Surge: Tapping into Home Equity

What’s happening here? We’re seeing a massive spike in refinance activity compared to last year—a staggering 247.9% increase year over year! While the week-over-week numbers dipped slightly by 3.6%, the 4-week average still shows a solid 13.6% rise. This surge in refinancing isn’t about locking in those historically low 3% rates we saw in 2020. Instead, homeowners are freeing up equity, even though current rates are certainly higher.

Why is this important? It indicates that many homeowners are strategically tapping into their home equity to fund renovations, pay down debt, or invest in new opportunities. This move highlights a shift in focus—people are leveraging their property’s value to make financial moves now, rather than waiting for another drop in interest rates. This trend could be a sign that homeowners are preparing for what’s next in the evolving market landscape.

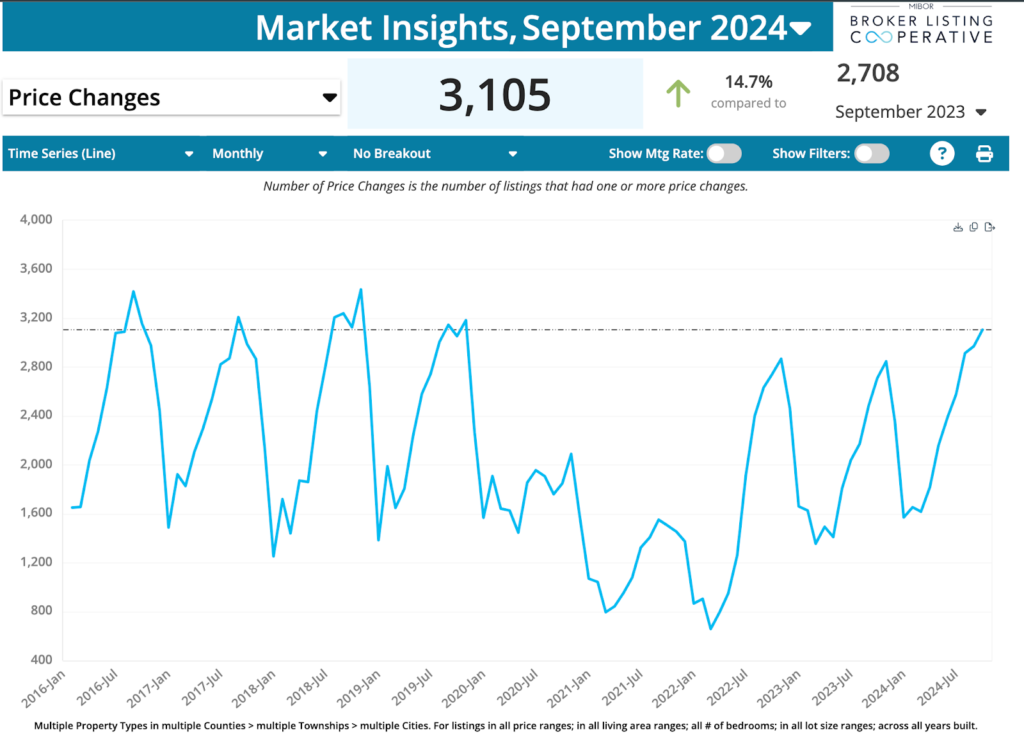

Price Changes: The Shift Giving Buyers the Edge Right Now

Historically, price changes in the Indianapolis market have followed predictable patterns, with sellers typically making minor adjustments during the slower fall and winter months. From 2016 to 2021, these price shifts were relatively modest, as strong demand kept the market competitive and in the seller’s favor. During those years, buyers had limited leverage, and price reductions were not as common or significant.

Fast forward to 2023 and 2024, and we’re seeing a complete turnaround. The data shows a spike in price changes, with September 2024 reaching the highest levels we’ve seen in years. Sellers are dropping their listing prices more aggressively to spark action and attract hesitant buyers. We now have more active listings on the market than at any point in the last 16 months, creating a scenario where buyers hold the upper hand.

Why does this matter now? Because this market environment is a rare window of opportunity for buyers that might not last long. With predictions of further interest rate drops in the spring of 2025, demand is expected to surge once again, which could easily tip the scales back in favor of sellers. Right now, buyers have the advantage of lower interest rates, a higher number of active listings, and more price drops than we’ve seen in a long time—essentially, a buyer’s playground.

The combination of motivated sellers and the current conditions gives buyers a unique position of leverage and choice. Acting now, before demand increases in 2025, allows buyers to secure the best deals with the most favorable terms. The current market is offering the perfect storm of opportunity that buyers haven’t seen in years, making this the time to move before the landscape shifts once again.

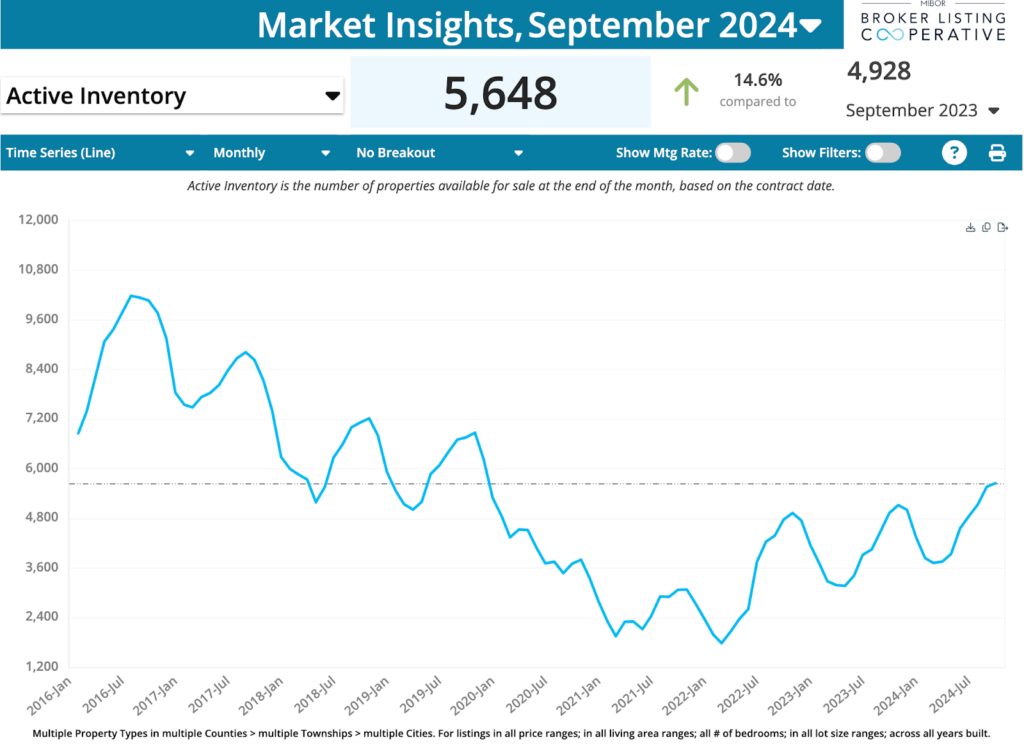

Active Inventory: More Options, More Power for Buyers

Let’s talk inventory. September 2024’s active listings hit 5,648 properties, a solid 14.6% increase compared to September 2023. This bump in inventory is a big deal because it means there are more options on the market right now than we’ve seen in the last 16 months. We’re finally seeing levels rise from the painfully low points of 2021 and 2022, and this trend is giving buyers a real edge.

With more listings to choose from, buyers have more negotiating power and flexibility than they’ve had in years. It’s no longer a game where sellers call all the shots—buyers have the leverage to make moves on their terms. Combine that with the recent wave of price drops, and you’ve got a market that’s finally shifting in favor of those looking to buy.

Here’s why this matters: everyone’s talking about interest rates possibly dropping in the spring of 2025, and that’s likely to bring a surge of demand back into the market. But right now, we’re in a sweet spot where inventory is high, prices are dropping, and interest rates are lower than they’ve been in a while. This is the time to take action before the market heats up again.

If you’re a buyer, the stars have aligned in your favor. More listings, motivated sellers, and better rates mean the opportunity is here right now—not in 2025. Don’t wait until everyone else jumps in; this is your moment to make the most of the market while it’s still a buyer’s playground.

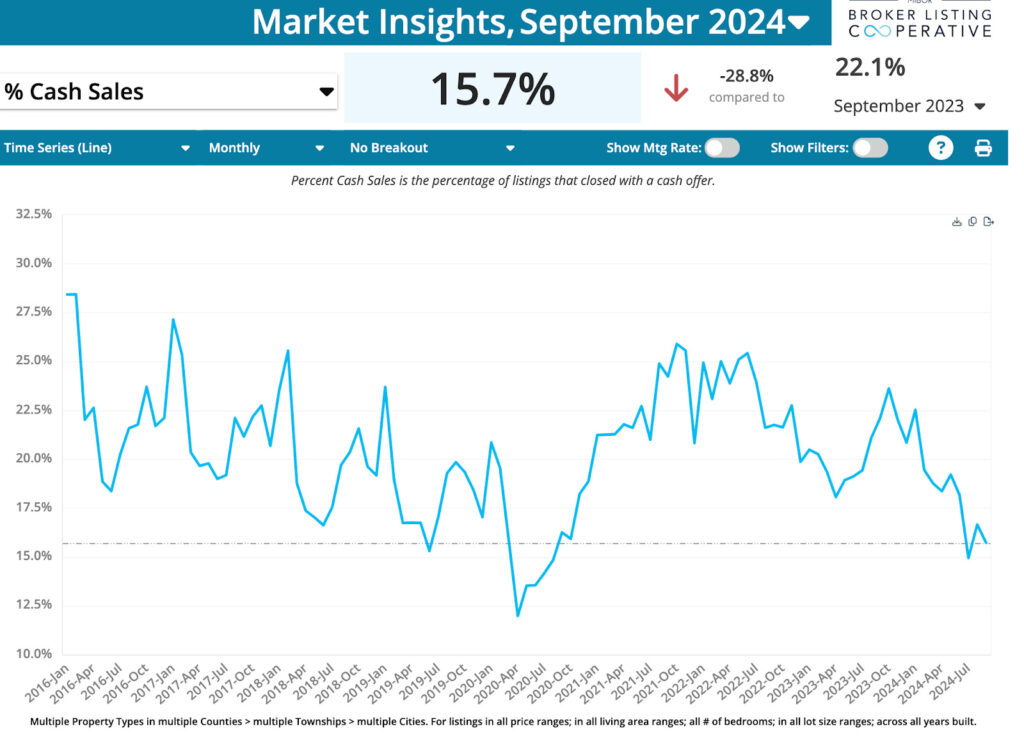

Cash Sales: A Shift Back to Traditional Buyers

The data on cash sales tells an interesting story about how the market is evolving. In September 2024, cash sales dropped to 15.7%, a significant 28.8% decrease from the 22.1% recorded in September 2023. This decline marks one of the lowest levels of cash transactions we’ve seen in the past eight years. During the peak periods from 2020 to 2022, cash buyers dominated the market, with cash sales consistently making up over 20% of transactions. Back then, investors and cash-rich buyers were snapping up properties quickly to avoid bidding wars and take advantage of low interest rates

Now, with cash sales on the decline, the playing field has shifted in favor of traditional buyers using mortgages. For the first time in years, those relying on financing have more opportunities to compete without facing the intense pressure from cash-heavy offers. With predictions of interest rate drops on the horizon in 2025, this trend could be a game-changer. Buyers using financing have a unique window right now to secure a property before investor activity heats up again, making it an ideal time to act while the leverage is still on their side.

With everything we’ve discussed, it really feels like the stars have finally aligned for buyers. Between increased inventory, motivated sellers, price drops, and a decline in cash competition, there hasn’t been a better time to act in years. Honestly, with all these factors in play, even I’m tempted to go out and buy an investment property right now!